Table of Contents

ToggleWidner Mobility Oscillator MetaStock An In-Depth Guide

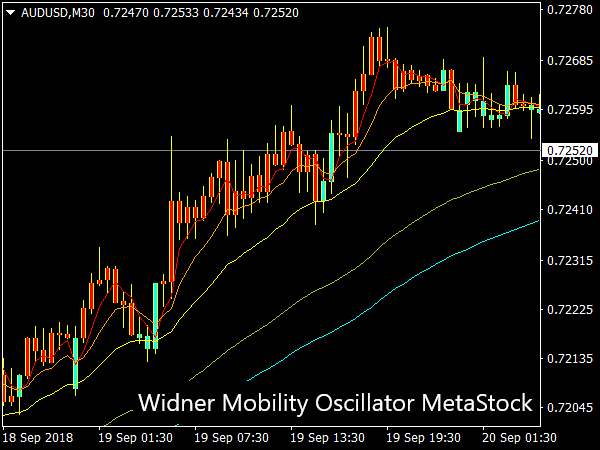

Introduction to the Widner Mobility Oscillator in MetaStock

The Widner Mobility Oscillator is a valuable tool for traders using MetaStock software, designed to help identify market trends and potential reversal points. In this article, we’ll delve into the mechanics of the oscillator, its applications in trading, and how you can implement it effectively in your trading strategies.

What is the Widner Mobility Oscillator?

The Widner Mobility Oscillator is a technical analysis indicator that measures the momentum of price movements. Unlike traditional oscillators that merely signal overbought or oversold conditions, this oscillator offers insights into the volatility and strength of price movements.

Traders often use it to spot potential entry and exit points by analyzing the relationship between the price and the oscillator values. When Widner Mobility Oscillator MetaStock combined with other indicators, it can enhance decision-making processes and improve overall trading performance.

How Does the Widner Mobility Oscillator Work?

The Widner Mobility Oscillator operates by calculating the difference between a shorter-term moving average and a longer-term moving average of price movements. The oscillator oscillates around a zero line, where values above zero indicate upward momentum, while values below zero suggest downward momentum.

Key Components of the Widner Mobility Oscillator MetaStock

- Short-Term Moving Average (SMA): A quick-reacting average Widner Mobility Oscillator MetaStock reflects the latest price movements.

- Long-Term Moving Average (LMA): A slower average that provides a broader view of price trends.

- Oscillator Line: The line that oscillates above and below the zero line, providing signals based on Widner Mobility Oscillator MetaStock position and movement.

Calculation

The formula for the Widner Mobility Oscillator can be expressed as follows:

WMO=SMA(n)−LMA(m)\text{WMO} = \text{SMA}(n) – \text{LMA}(m)WMO=SMA(n)−LMA(m)

Where:

- SMA(n)\text{SMA}(n)SMA(n) = Short-term moving average over nnn periods.

- LMA(m)\text{LMA}(m)LMA(m) = Long-term moving average over mmm periods.

Setting Up the Oscillator in MetaStock

To use the Widner Mobility Oscillator in MetaStock, follow these steps:

- Open MetaStock: Launch your MetaStock application and navigate to the charting section.

- Add Indicator: Click on “Insert” in the menu, then select “Indicator.”

- Choose Oscillator: Find the Widner Mobility Oscillator from the list of indicators or create a custom formula if it isn’t available.

- Configure Parameters: Set your preferred periods for the short-term and long-term moving averages.

- Analyze: Observe the oscillator line in relation to the zero line and other market indicators.

Trading Strategies Using the Widner Mobility Oscillator

Divergence Trading

One of the most effective strategies with the Widner Mobility Oscillator is divergence trading. This occurs when the price of an asset moves in the opposite direction of the oscillator. For example, if prices are making new highs while the oscillator fails to reach new highs, this could indicate a potential reversal.

Trend Confirmation

When the oscillator line crosses above the zero line, Widner Mobility Oscillator MetaStock suggests upward momentum, confirming an uptrend. Conversely, crossing below the zero line indicates a downtrend. Traders can use these signals to confirm trends before entering positions.

Signal Alerts

Set alerts in MetaStock to notify you when the Widner Mobility Oscillator crosses above or below the zero line. Widner Mobility Oscillator MetaStock can help you stay informed and make timely trading decisions.

Combining with Other Indicators

For improved accuracy, combine the Widner Mobility Oscillator with other indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Widner Mobility Oscillator MetaStock multi-faceted approach can provide stronger signals and reduce the likelihood of false positives.

Advantages of the Widner Mobility Oscillator

- Clear Signals: The oscillator provides clear buy and sell signals based on its position relative to the zero line.

- Volatility Measurement: It measures price volatility, which can help traders adjust their strategies based on market conditions.

- Versatility: The Widner Mobility Oscillator MetaStock can be applied across various asset classes, including stocks, commodities, and forex.

Limitations of the Widner Mobility Oscillator

- Lagging Indicator: Like many oscillators, the Widner Mobility Oscillator can lag in signaling price movements, potentially leading to missed opportunities.

- False Signals: In volatile markets, the oscillator can produce false signals, making it essential to combine it with other indicators for confirmation.

- Market Context: It’s crucial to consider the broader market context, as external factors can influence price movements and oscillator readings.

Conclusion

The Widner Mobility Oscillator in MetaStock is a powerful tool for traders seeking to enhance their technical analysis capabilities. By understanding its mechanics and implementing effective trading strategies, you can leverage this oscillator to make informed trading decisions. As with any trading tool, practice and experimentation are key to mastering its use and achieving success in your trading endeavors.

By integrating the Widner Mobility Oscillator with your trading routine, you can potentially improve your market insights and performance, leading to more successful trading outcomes. Always remember to combine it with sound risk management practices and continuous learning to navigate the complexities of the financial markets effectively.